Things about Estate Planning Attorney

Table of ContentsEstate Planning Attorney Fundamentals ExplainedThe Ultimate Guide To Estate Planning AttorneyRumored Buzz on Estate Planning AttorneyThe Basic Principles Of Estate Planning Attorney

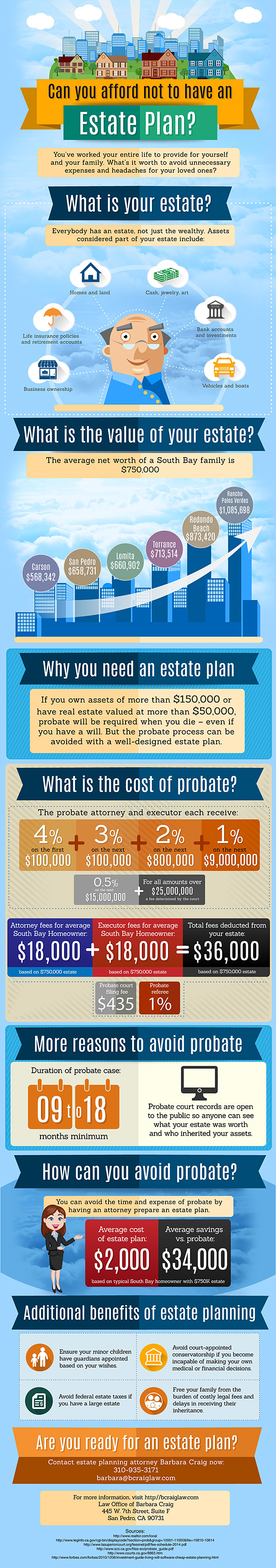

Estate preparation is an action strategy you can use to determine what takes place to your assets and responsibilities while you live and after you die. A will, on the various other hand, is a legal record that describes exactly how properties are distributed, who looks after youngsters and pet dogs, and any kind of various other desires after you die.

Insurance claims that are denied by the executor can be taken to court where a probate judge will certainly have the last say as to whether or not the case is legitimate.

Some Known Facts About Estate Planning Attorney.

After the supply of the estate has been taken, the value of properties computed, and taxes and debt settled, the executor will then look for consent from the court to distribute whatever is left of the estate to the beneficiaries. Any inheritance tax that are pending will certainly come due within nine months of the day of fatality.

Each private areas their properties in the trust and names someone other than their spouse as the beneficiary. A-B depends on have actually come to be much less prominent as the estate tax obligation exception works well for a lot of estates. Grandparents might transfer possessions to an entity, such as a 529 plan, to support grandchildrens' education.

Estate Planning Attorney - An Overview

This approach involves cold the worth of a property at its value on the date of transfer. As necessary, the amount of potential capital gain at fatality is likewise frozen, permitting the estate coordinator to estimate their prospective tax obligation liability upon fatality and better prepare for the repayment of revenue taxes.

If adequate insurance coverage earnings are readily available and the policies are effectively structured, any kind of earnings tax obligation on the deemed dispositions of possessions adhering to the death of an individual can be paid without turning to the sale of properties. Profits from life insurance coverage that are obtained by the recipients upon the fatality of the guaranteed are generally he has a good point earnings tax-free.

There are particular documents you'll require as part of the estate preparation procedure. Some of the most usual ones include wills, powers of attorney click to find out more (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is just for high-net-worth people. Estate preparing makes it simpler for individuals to determine their dreams prior to and after they die.

The Of Estate Planning Attorney

You ought to begin planning for your estate as quickly as you have any quantifiable asset base. It's a recurring process: as life advances, your estate strategy should move to match your situations, in line with your brand-new objectives.

Estate preparation is usually believed of as a device informative post for the rich. Estate planning is additionally a great means for you to lay out strategies for the care of your small kids and pet dogs and to detail your dreams for your funeral service and favorite charities.

Applications have to be. Qualified candidates who pass the examination will certainly be officially licensed in August. If you're eligible to rest for the examination from a previous application, you may file the short application. According to the guidelines, no accreditation will last for a duration longer than 5 years. Figure out when your recertification application is due.

Comments on “The Ultimate Guide To Estate Planning Attorney”